More Junkmail from Bob!

Tuesday, October 22, 2002Important Stuff.

Bidness Ramblings

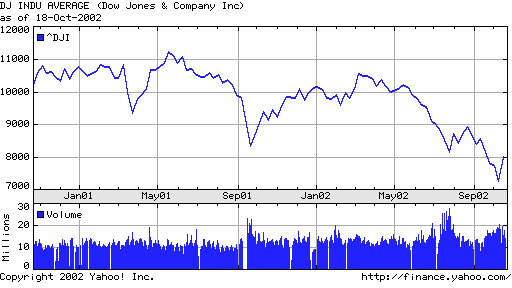

The stock market has gone down a lot recently. It lost almost 1/3 of its value since last Spring. Politicians were getting a little panicky. Corporate executives were (and are) getting fired. Congress was getting excited and trying to all kinds of laws punishing the criminal corporate executives for heinous deeds.

Then two things happened. First, the market went up about 10%. This meant people weren't quite so panicky about losing all their money. Second, the elections progressed from the money-raising stage to the advertising stage. This meant that politicians didn't have to please the people with lots of money any more because most of the large donation decisions had already been decided. Coincidentally, most of the market reform talk we heard several weeks ago has mysteriously disappeared.

Here's the Dow Jones Industrial Average over the past two years.

What's the fundamental problem with the stock market? There's not one, if you get down to the fundamentals. A company is worth the money it makes. The stock price reflects this, in theory. The stock price should be closely related to the profit (or earnings) a company makes.

Suppose you buy 9,950,000,000 shares of General Electric, at Monday's price of $27.15. You would own the entire company, and it would cost you around $270,000,000,000. Is it worth that much? Well, GE made about $16 billion last year, plus a dividend yield of 2.7%. If you got to keep all the profit and dividends, and you could if you owned the entire company, you would make about 8.6% on your investment. Is this better or worse than you could get in the bank?

There are some additional factors to consider, such as whether the company's profits will increase, and whether you can sell the stock in the company at a profit sometime in the future.

The big question is can GE produce what it sells, whether it's a service or a product, at a price that the customers will buy it? Management, marketing, and a lot of complex issues are involved here. That is basic business.

One thing that is not important to the GE's customers is whether GE "meets analysts' expectations," or "makes its quarterly numbers." Stock market people analyze, predict, and guess how much money GE will make every three months. A lot of investment professionals use these numbers to decide whether to buy or sell GE stock. If GE makes less than the "numbers", then the investment professionals have re-evaluate, and some of them will sell instead of buy GE stock. This causes the stock price to drop some. By the same token, of GE beats the numbers the stock price may go up.

There is another level of indirection here, however. The general consensus of investment professionals may be that GE will beat the quarterly numbers. Then, if GE only meets the numbers, or makes as much money as was officially predicted, then people may change from buying to selling, causing the price to drop.

This is a simplified view. It doesn't consider news, external factors, how the GE's industry does, and a bunch of other stuff. The stock price is also affected somewhat by the longer-term outlook of the company. Some companies have never made a dime, but the stock price reflects their expected long-term profitability, at least theoretically.

But a company's quarterly results do have a direct effect on the company's stock price. Generally, this effect lasts for about a quarter -- three months. By then, people are looking to the next quarter's numbers.

If the stock price goes down because GE doesn't perform as expected during the quarter, it's not very important to anybody except the people who own GE stock. The customers are interested in buying light bulbs or nuclear reactors or jet engines. As long as GE delivers and treats its customers right, the stock price is irrelevant. Eventually, if GE does a good job in business, the stock price will catch up. If GE does a bad job in business, the stock price will eventually go down.

But the immediate stock price may be very important to some people. Among others, people who have the majority of their savings in GE stock may be very concerned about the stock price. Coincidentally, most of the people who fall into this category are likely to be GE upper management.

So that's how we get a company whose upper management is concerned primarily about the stock price rather than the business itself and the customer. Actually, GE probably does not have this problem. I just used them for an example.

For some public companies, the quarterly numbers are the reason for their existence. This is because the management of these companies owns lots of stock and they want the stock price up fast so they can sell, trade, or otherwise cash in. Also, stock in a weak company can be used to buy a financially stronger company. This gives incentive for some companies to manipulate the books any way they can to "make the numbers."

Usually this is done in above board and legally, or at least in a "gray" area. For example, a company may push to ship all the orders it possibly can by the end of the month in order to raise sales and profits for the current quarter. Of course, this takes sales away from the next quarter.

In December of 2000, AOL was so desperate to show an increase in sales that they made a special deal with Telefonica, a Spanish communications company. The ad was displayed to AOL's English speaking customers, among others, in the prime ad location for AOL. The ad linked to a web site in Spanish, and the service being advertised was not even available in the U.S. or U.K. This cost AOL a lot of money and some credibility, but they got to log the advertising sales in 2000.

From the Washington Post:

"The pressure inside AOL tightened like a vise: The stock was eroding, and the firm was engaged in tedious negotiations with federal regulators reviewing the merger. Enough failing dot-com advertisers could compound the problems.

"For months, AOL managed to keep up its ad revenue from dot-coms by restructuring their deals into shorter-term arrangements. But by mid-December 2000, it became harder to find revenue. In at least one instance, business affairs pushed too far.

"The unit brokered a deal to sell $15 million in online ads to Telefonica SA, the big Spanish telecommunications company. AOL needed to run the ads in the final days of December to book the revenue in that quarter.

"But with so little time left, AOL had to place the ads in high-traffic areas of AOL, such as its welcome screen, the first Web page people see when they use the service. More consumers saw ads on the welcome screen and AOL could get faster credit for running the promotions.

"AOL officials didn't care that the Telefonica link from AOL's English-language welcome screen took users to a Spanish-language site, said AOL sources familiar with the deal. Nor did it matter that Telefonica's computer servers couldn't handle all of the customer traffic from AOL, they said."

http://www.washingtonpost.com/ac2/wp-dyn/A28624-2002Jul18

A company can move income from the coming quarter to the current quarter using a variety of accounting and operational schemes, some legal and some not. Sometimes a company will adversely affect its customers in order to meet the numbers. Sometimes a company will actually lose money in order to move the income from the next quarter into the current quarter.

For example, maybe a customer has a large order to be delivered next month. A company may offer a large discount to get the customer to accept delivery early, in order to log the sales in the current quarter. The company then loses profit but the current quarter looks better.

Some companies move money from the expense column of the balance sheet into the assets column. Sometimes this is legitimate. For example, if a company develops software, they have the option of calling some of the expenses capital expenditures, and then they don't have to call all the development expense an expense. But then, some companies have moved the money from expenses into capital expenditures to illegally hide losses. Worldcom was pretty good at this.

Why would anybody do this? To keep the stock price up for 90 days. Either they are very shortsighted, or they intend to sell some stock they own within that period. Or in AOL's case, maybe they have a merger to complete.

This robs the income from the next quarter and makes it hard to meet those numbers. If this keeps going on for a while and there are no huge windfalls to fill in the holes, there has to be a bad quarter and the stock price falls.

What happens when the end is near? Merger! AOL was making great increases in profit and revenue (sales) for several years. Then they growth began to slow. AOL used their inflated stock to buy Time Warner for the low, low price of $106,000,000,000. They paid in stock, not money. This was actually a lot less than the original price because AOL's stock dropped from the time the merger was announced in January 2000 to the time it was completed in January 2001. After the merger the stock in the combined company was worth about $205 billion. Today it's worth about 1/4 that amount.

Who made money on the deal? AOL management and a bunch of lawyers made lots of money. AOL and Time Warner shareholders obviously didn't do so well.

The merger hid the fact that AOL's growth was slowing, for a while. They had lots of one-time charges related to the merger. They could move some ordinary business activities into these on-time charges. Many investors don't consider these one-time charges, merger-related expenses, and reorganization expenses to be very important. They just look at the operation numbers. The increased overhead of the merger was easy to ignore, with management touting the great synergy of the new company.

http://www.unitedmedia.com/comics/dilbert/archive/images/dilbert2731510021021.gif

Earlier this year, AOL took another write-off -- $54,000,000,000 worth. Why? Because the value of the stock used to buy Time Warner had decreased. I had to laugh. This is the largest charge-off in U.S. business history. For some reason, this caused a further stock price drop. The only thing that seems to be able to support this company's stock price is profit. Strange, huh?

Here's another Washington Post article on AOL. Since these articles came out last summer, the stock price dropped substantially.

http://www.washingtonpost.com/ac2/wp-dyn/A21983-2002Jul17

A day or so after this article came out, COO Pittman resigned from AOL.

http://wired.com/news/exec/0,1370,53971,00.html

Three months later, CEO Levin announced his retirement.

I like to pick on AOL because they're an easy target, but there are lots of other companies who have recently had big problems trying to prop up the stock price without much underlying fundamental business. Dotcoms are represented quite well in this group.

Cray's Red Storm

In 1972 a guy named Seamore from Chippewa Falls, Wisconsin started a company called Cray Research. He called it Cray Research because his last name was Cray. Four years later, Cray Research sold their first computer to Los Alamos National Laboratory. The Cray 1 was the fastest computer on earth, with a blinding speed of 160 million floating point operations per second (mflops). For comparison, the computer I'm using to write this Junkmail tests at about 2000 mflops. The Cray 1 had 8 megabytes of RAM, compared to 512 megabytes on the system I'm using.

http://cray.com/company/history.html

Yesterday Cray announced a $90 million contract to build a new supercomputer with Sandia National Laboratories. It will use about 16,000 AMD Opteron CPUs, and is expected to run at 100 trillion operations per second. I'm not sure whether this is floating point operations or regular operations, but either way it should be a fairly fast computer. I think it would be pretty interesting to write software for 16,000 CPUs.

http://www.infoworld.com/articles/hn/xml/02/10/21/021021hnopteron.xml

Forgive and Forget

The other day I mentioned that a Learn2 director borrowed $1.2 million dollars or so from the company, and then the company decided he wouldn't have to pay the money back. This was particularly bad because Learn2 didn't have the money to loan. A few days ago I ran across an article today about this practice. It seems that Learn2 is not alone.

In December 2000, Microsoft floated a loan to its president Rick for $15 million. Microsoft took some of his stock options as collateral, even though they were "underwater" and had no value at the time. Rick resigned a few weeks ago and he took his $15 million with him. Microsoft forgave the loan.

What other corporate execs borrow money? Former Worldcom CEO Bernie borrowed a paltry $160 million. He hasn't paid them back yet. Here are 49 others.

http://www.business2.com/articles/mag/0,1640,44304,FF.html

Another interesting fact, according to New York Fed President William McDonough: The average chief executive officer's pay has gone from 42 to 400 times that of the average production worker in the past 20 years.

Stupid Patents

PanIP is a company in San Diego. It's business? Suing people. PanIP has a couple of patents. Patent 5,576,951 is for an "automated sales and services system." Patent 6,289,319 is for an "automatic business and financial transaction-processing system."

Sound a little general? They are. I think they apply to just about anybody doing e-commerce. But PanIP is suing people anyway. They've sued about 50 small businesses so far. They'll drop the lawsuits if their target companies agree to pay them a one-time "license fee" of $5,000 - $30,000. A lot of the small businesses pay them off, because it's cheaper than attorney fees. It sounds like legalized extortion to me.

http://www.informationweek.com/story/IWK20021020S0002

Here's another stupid patent:

http://www.informationweek.com/story/IWK20021004S0040

Even my genes have been patented. This doesn't sound like such a big deal, but it's put a stop to breast cancer testing in British Columbia.

http://www.canada.com/vancouver/story.asp?id={0D0279FC-B2F4-48CA-9A46-6DFF52DE2173}

Here's a commentary on some recent patents business.

http://www.wired.com/news/print/0,1294,55831,00.html

Not-so-Private Privacy Policy

I went to Best Buy's web site and they asked me to check a box that said I agree with their new privacy policy. I usually just check these boxes, because if I don't the company won't let me give them my money. I was particularly bored this day, apparently, because I read the policy. My favorite part is titled "Does Best Buy Share the Information I've Provided?"

"Best Buy may need to share personal information with third parties in limited circumstances. For example, we may release personal information to third parties to: perform services on our behalf, fulfill our customer's orders, send marketing communications, deliver packages, schedule and perform installation, send postal mail and email, or process credit card payments."

If you scan over this, you may miss the important parts. There are two pieces in this non-exclusive set of examples that stand out to me: "send marketing communications" and "send postal mail and email". This means Best Buy may give my information to anybody who wants to send me marketing communications, better known as advertising.

It also means that Best Buy may give my information to anybody who wants to send me mail or email. I'm guessing that they will be sending me advertisements, since people rarely send me money by mail and even more rarely by email.

http://www.bestbuy.com/infoCenter/Policies/newPrivacy.asp#03

Most of the newer privacy policies I've seen have similarly buried non-private privacy provisions.

Misplaced People

The Florida Department of Children & Families has lost track of 199 children it was supposed to be supervising. And they say they have been improving. My guess is that this has been going on long enough and with enough missing people that it's messed up the Florida elections. We should have recounts.

http://www.miami.com/mld/miami/4324484.htm

Norelco Torpedoes

About 12 years ago a Greenpeace ship was wandering around a Soviet nuclear testing ground. A Soviet sub was tailing the Greenpeace ship. The Greenpeace ship was stopping and starting and turning randomly, which made it a pain for sub to follow since the sub didn't turn or stop very fast. So the sub executed a torpedo attack maneuver. The Greenpeace people recognize the maneuver and got a little nervous. Then captain's senior mate Boris got out his electric razor, turned it on, and sent the noise out over the water. The Greenpeace people thought it was a torpedo, and they took off as fast as their boat would go.

http://english.pravda.ru/main/2002/10/21/38438.html

The Soviet sub was called the Andromeda. Here's a picture of Andromeda.

Spam and Music Sharing

Even spammers think there is too much spam. I think they're right.

http://wired.com/news/business/0,1367,55951,00.html

I've been surprised at the increase in spam over the past year or two. I think the government will do something to slow it down, AFTER the election season.

I've also been surprised at the increase in music exchange going on via Kazaa and other programs. I expect this will have to stop before long. Microsoft is pushing a free exchange of files, with copy protection built into Windows Media Player. This ensures people will use Windows Media Player. I think this is a lot better approach than governments requiring every new piece of any kind of software to use the Recording Industry's copy protection scheme. Either way, music sharing has gotten so widespread that I think it will be stopped or at least substantially slowed before long.

Queen of Iqaluit

A few weeks ago, I made a trip to Europe in the PC12. Over the ocean on the way back from Greenland, we learned that Queen Elizabeth was going to be at Iqaluit, Canada, our destination, just before we were. I guess she didn't want to talk to us because they wouldn't let us land until she was gone from the airport. Here's a picture of her plane, Royal 01. The pilot (or whoever was on the radio) was very nice about being in everyone's way.

Here is the Queen in Iqaluit, who we didn't see. That was probably just as good since I didn't know whether to bow, kneel, shake hands, or what, and I wasn't sure whether to call her "Your Majesty", "Your Highness", "Your Excellence", or "Liz".

http://www.nac.nu.ca/queen_visit.html

Here are some pictures I took flying around the Frobisher Bay area waiting on the Queen.

Pryor Open 2002 Results and Pictures: http://pryorrotary.org/tennis

Pictures of Today!

Here are a couple of NASA photos of the space station. These were photographed by a crewmember on board the Space Shuttle Atlantis following the undocking of the two spacecraft. Atlantis pulled away from the space station on October 16, 2002.

Regular size (1024x697):

High resolution (3032x2064):

Here's the NASA page:

http://spaceflight.nasa.gov/gallery/images/shuttle/sts-112/flightday10/ndxpage1.html

Pictures from Wales, France, and Scotland Last Month

(&c) 1944, no rights preserved. Any unauthorized duplication, distribution, or sharing of this fine piece of junk, whether electronically, or by helicopter, is OK with me. Patent not pending.

If you would like to sign up for Junkmail, go to

http://xpda.com/junkmail

If you'd like to read other Junkmails, go to the same site after seeking mental help.

If you'd like to stop getting this fine piece of alleged prose, please select one or more of these easy-to-use options:

1. Turn off your computer and leave it off.

2. Change your email address and don't tell anyone what the new one is.

3. Send me an email with "Kangerlussuaq" as the subject.

I'm Bob Webster and you can usually find me at bob@xpda.com

Have a good day!